41 coupon rate formula calculator

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ... Coupon Percentage Rate Calculator - MYMATHTABLES.COM Determines the coupon percentage rate using the face value and coupon payment. ... Step by Step calculation. Coupon Rate Formula. Coupon Rate is the ...

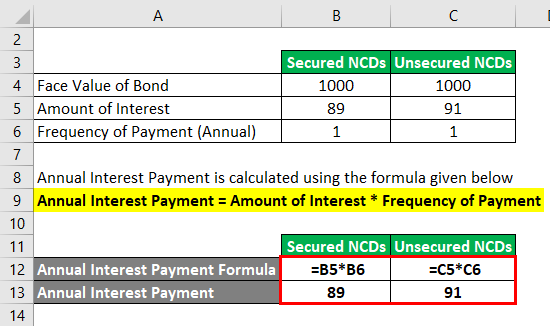

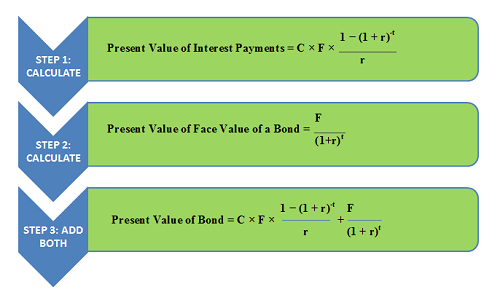

Current Yield Formula | Calculator (Examples with ... - EDUCBA Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield offered by other bonds in the market. Based on the fact that whether its coupon rate is ...

Coupon rate formula calculator

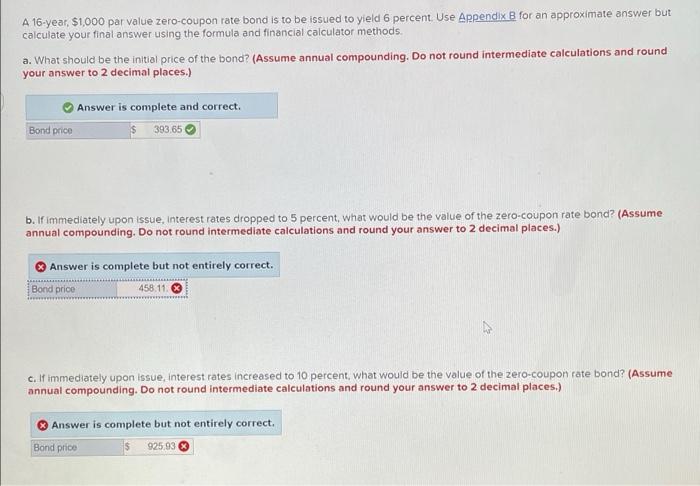

Unemployment Rate Formula | Calculator (Examples with Excel ... Unemployment Rate = 6,983 / (153,337 + 6,983) Unemployment Rate = 4.36% Therefore, the unemployment rate in the US during the year 2017 stood at 4.36%. Coupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Relevance and Uses of Coupon Rate Formula. Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg.

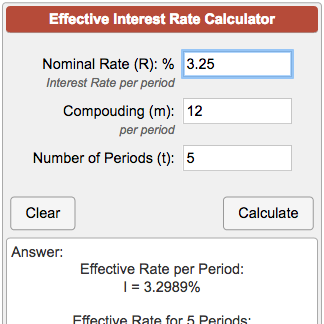

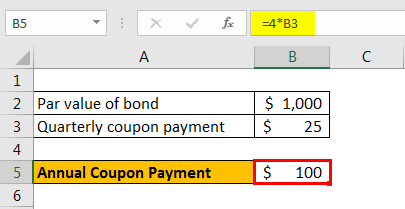

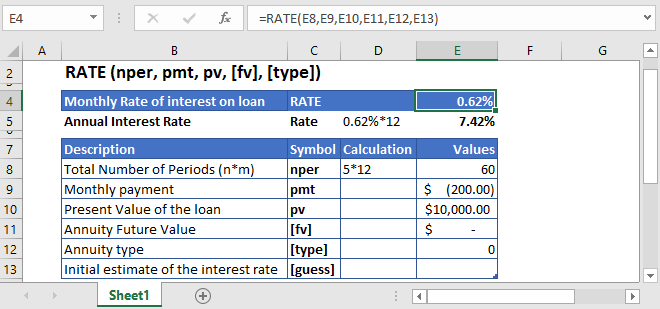

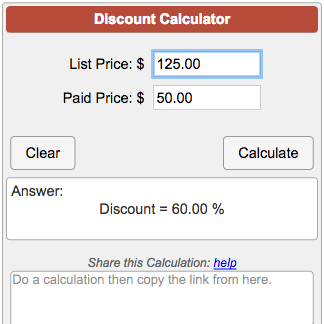

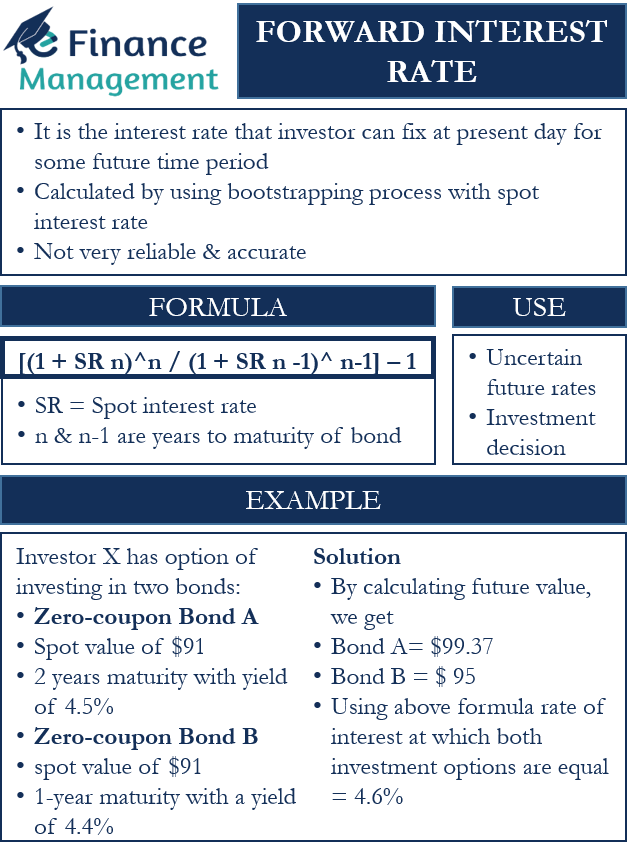

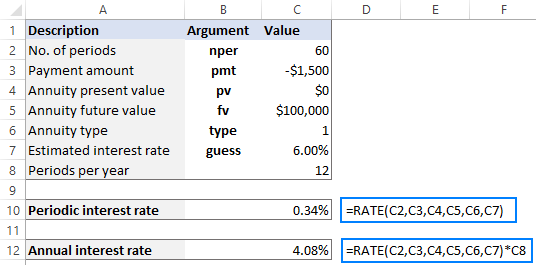

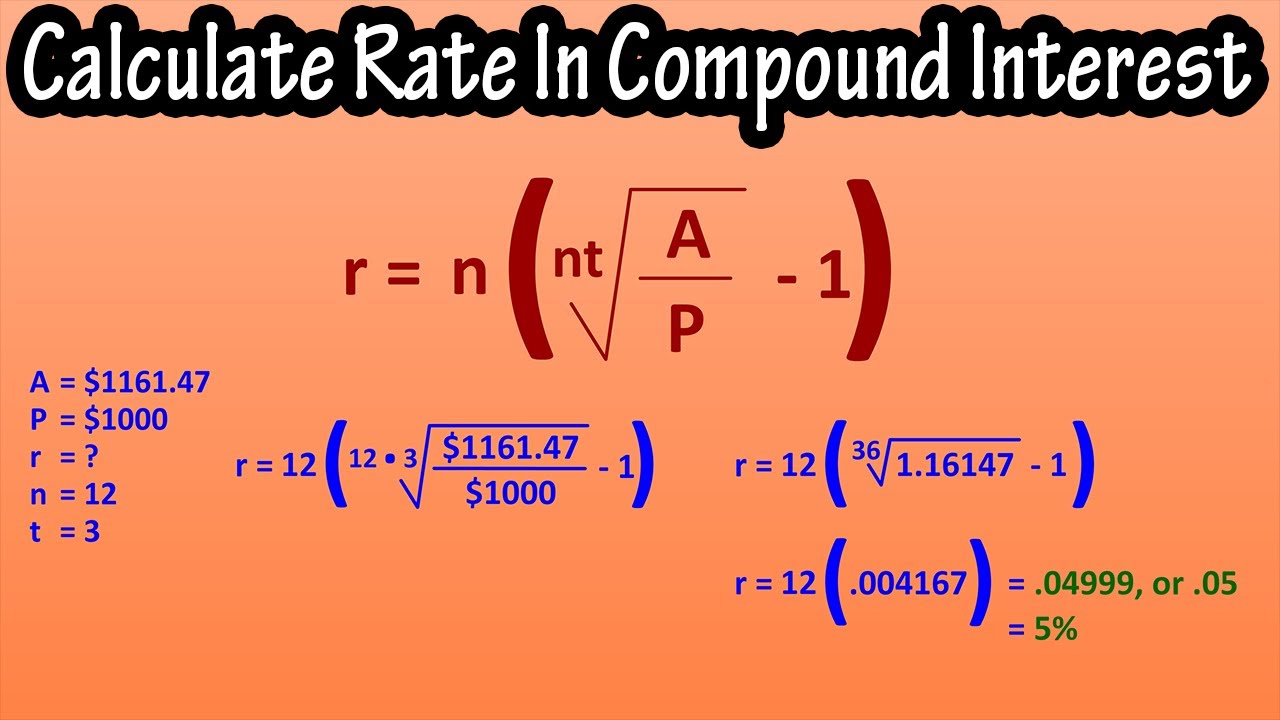

Coupon rate formula calculator. Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate Present Value Factor Formula | Calculator (Excel template) Now, in order to understand which of either deal is better i.e. whether Company Z should take Rs. 5000 today or Rs. 5500 after two years, we need to calculate a present value of Rs. 5500 on the current interest rate and then compare it with Rs. 5000, if the present value of Rs. 5500 is higher than Rs. 5000, then it is better for Company Z to take money after two years otherwise take Rs. 5000 ... Bond Price Calculator - Belonging Wealth Management If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is ... Required Rate of Return Formula | Calculator (Excel template) Step 4: Finally, the required rate of return is calculated by applying these values in the below formula. Required Rate of Return = (Expected Dividend Payment / Current Stock Price) + Dividend Growth Rate. Relevance and Uses of Required Rate of Return Formula. The required rate of return formula is a key term in equity and corporate finance.

Coupon Rate Calculator Aug 4, 2022 ... Coupon Rate Formula ... To calculate a coupon rate, divide the annual coupon payment by the par value of the bond, then multiply by 100. Coupon ... Bond Calculator - Financial Calculators Bond Calculator. Bond Price. Face Value. Annual Coupon Payment. Annual Yield (%). Years to Maturity. Or Enter Maturity Date. Compounding. Effective Tax Rate Formula | Calculator (Excel Template) - EDUCBA Here we discuss how to calculate Effective Tax Rate along with practical examples. We also provide an Effective Tax Rate calculator with a downloadable excel template. You may also look at the following articles to learn more – Guide To Cost of Capital Formula; Explanation of Cost of Debt Formula; Calculator For Diluted EPS Formula Coupon Rate Calculator - EasyCalculation Here is a simple online calculator to calculate the coupon percentage rate using the face value and coupon payment ... Coupon Percentage Rate Calculation.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon ÷ Par Value of Bond. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Relevance and Uses of Coupon Rate Formula. Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. Coupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by ... Unemployment Rate Formula | Calculator (Examples with Excel ... Unemployment Rate = 6,983 / (153,337 + 6,983) Unemployment Rate = 4.36% Therefore, the unemployment rate in the US during the year 2017 stood at 4.36%.

Post a Comment for "41 coupon rate formula calculator"