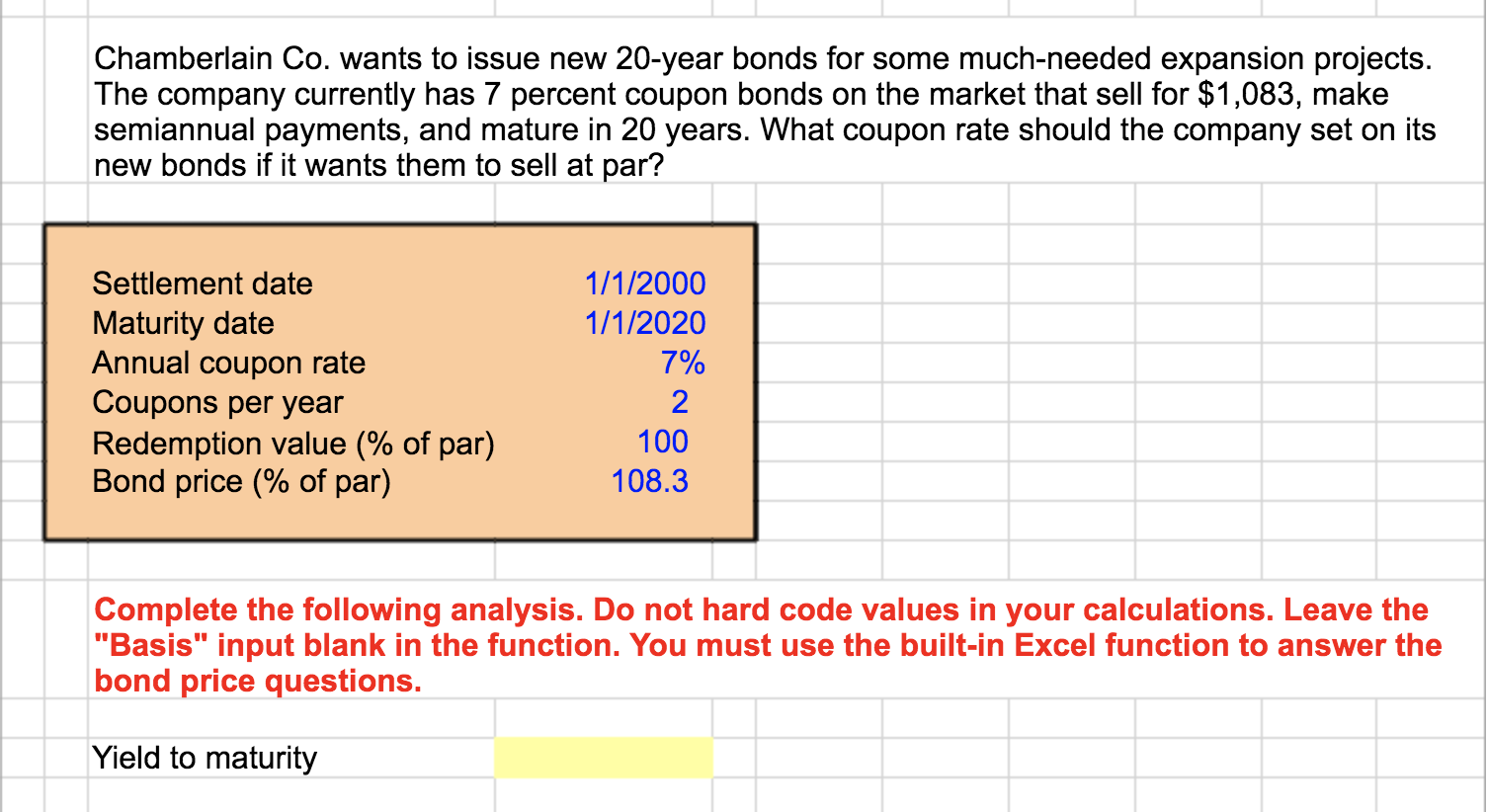

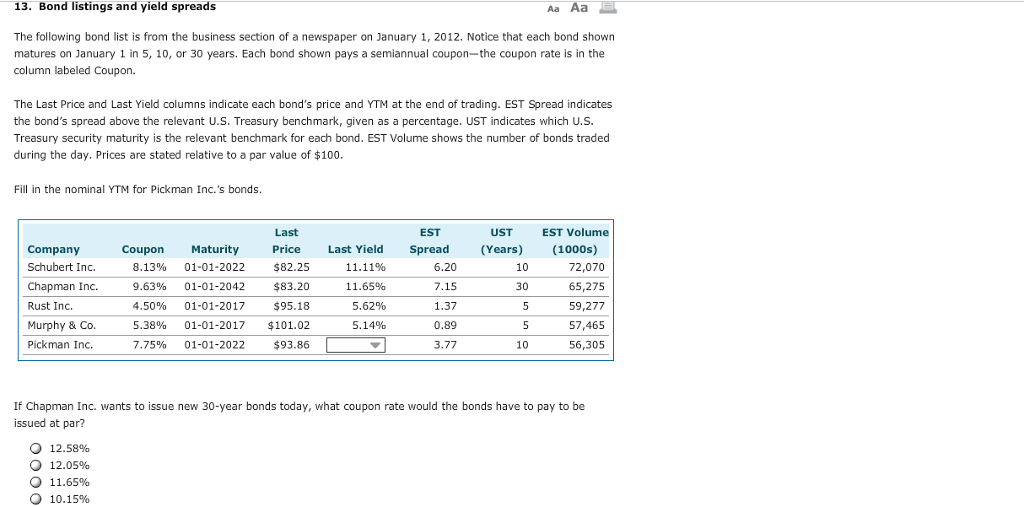

45 what coupon rate should the company set on its new bonds if it wants them to sell at par

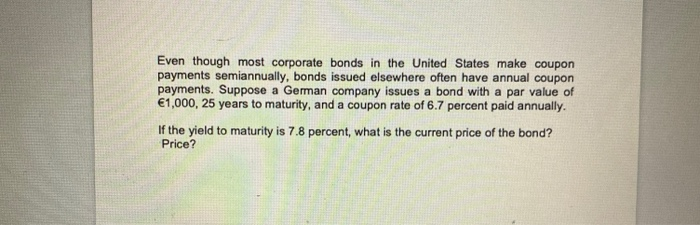

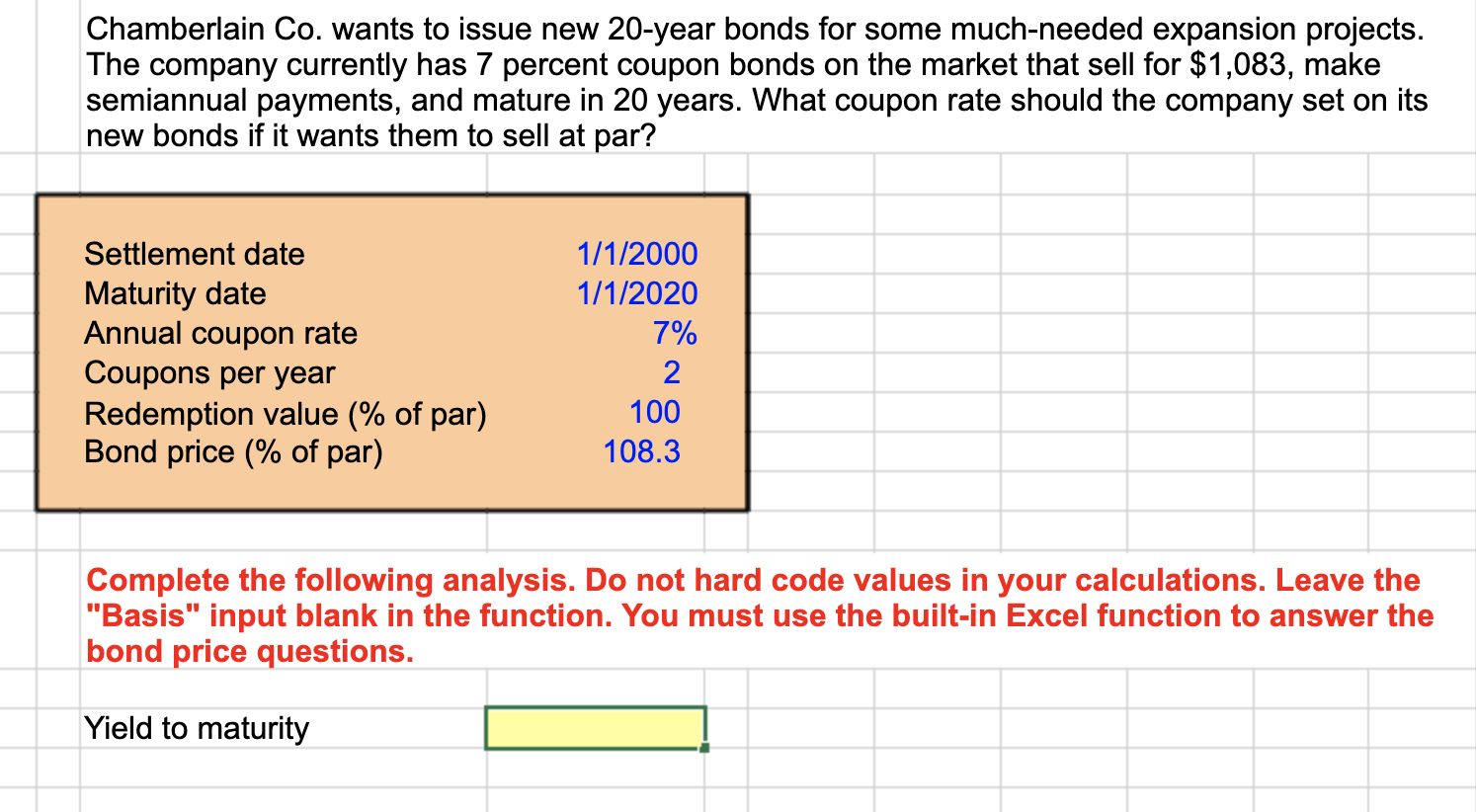

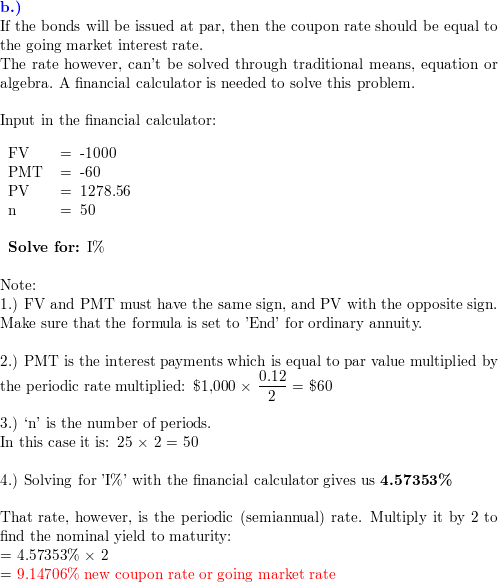

TUTORIAL BOND VALUATION.docx - TUTORIAL: BOND VALUATION... View TUTORIAL BOND VALUATION.docx from FINANCE MISC at INTI International University. TUTORIAL: BOND VALUATION Question 1 Mascara Inc. wants to issue new 30-year bonds for some much-needed expansion [Solved] Chamberlain Co. wants to issue new 20-yea - SolutionInn Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

[Solved] Uliana Co. wants to issue new 20-year bon | SolutionInn Uliana Co. wants to issue new 20-year bonds for some much needed. Uliana Co. wants to issue new 20-year bonds for some much needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company ...

What coupon rate should the company set on its new bonds if it wants them to sell at par

Press Releases | U.S. Department of the Treasury Statement by Secretary of the Treasury Janet L. Yellen on New Rule Under the Corporate Transparency Act September 28, 2022 Readouts READOUT: U.S. Department of the Treasury and the Office of the U.S. Special Presidential Envoy for Climate (SPEC) Host Discussion with Asset Managers and Insurers on the Opportunities and Challenges of Incorporating Climate … Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? simranstory9180 is waiting for your help. Add your answer and earn points. Expert-verified answer jepessoa Answer: 5.36% Pembroke co wants to issue new 20 year bonds for some - Course Hero See Page 1. Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

What coupon rate should the company set on its new bonds if it wants them to sell at par. BDJ Co. wants to issue new 25-year bonds for some much-needed expansion ... BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Welcome to Tribune Content Agency | Content Syndicate Welcome to the team! Gil Thorp comic strip welcomes new author Henry Barajas; Tribune Content Agency is pleased to announce Patti Varol as editor of the Los Angeles Times Crossword; Dick Tracy comic strip to have first female lead artist in 90 years; 24/7 Wall Street: slideshows based on data-driven journalism Solved Uliana Company wants to issue new 18-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer 100% (1 rating) Solution : Given, Maturity of the bond in years = 18 Coupon rate = 9% Current price of the bond, PV = $1,045 Par value of the bond, FV = $1,000 Semi-a … View the full answer Previous question Next question BDJ Co. - Coupon Rate Bonds - BrainMass BDJ Co. wants to issue new 10-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

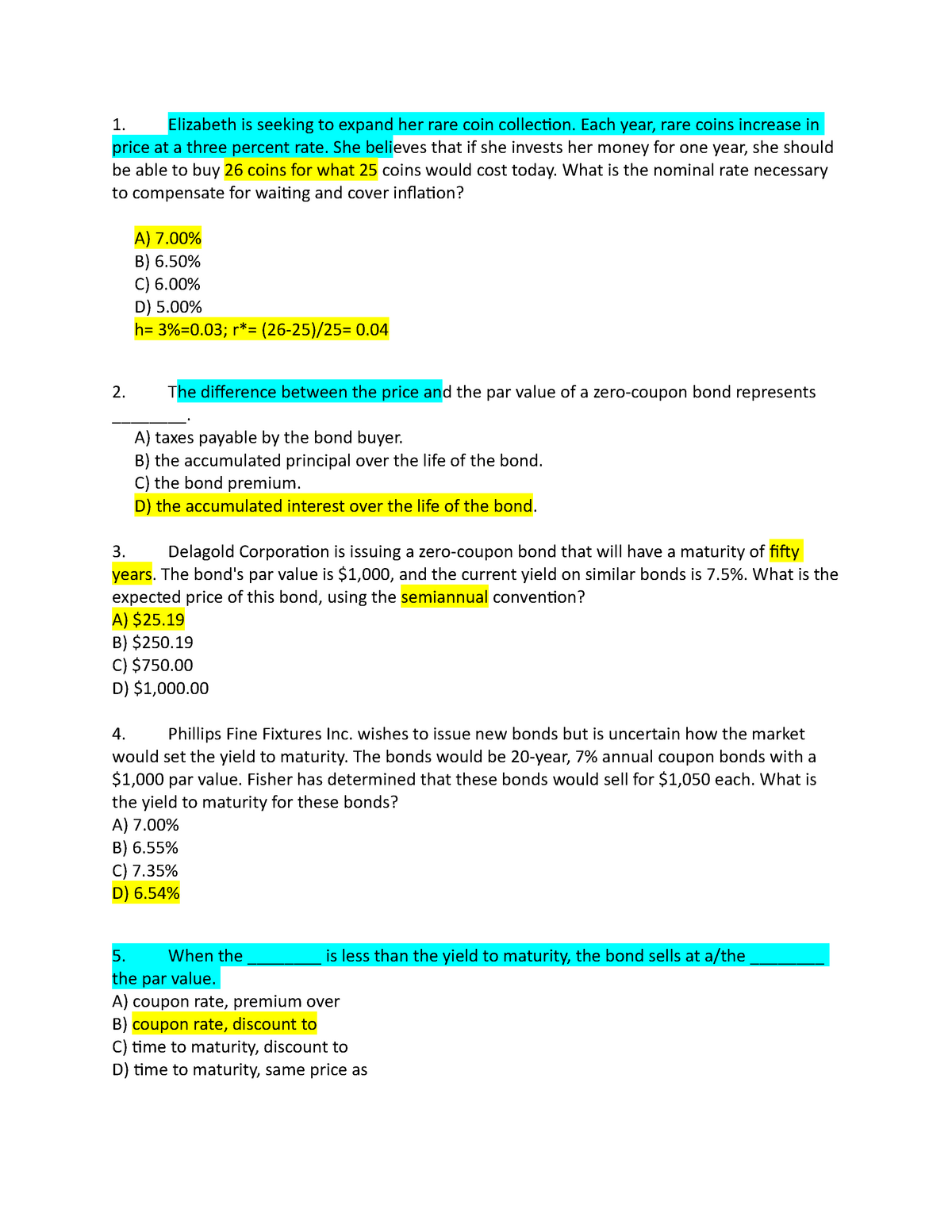

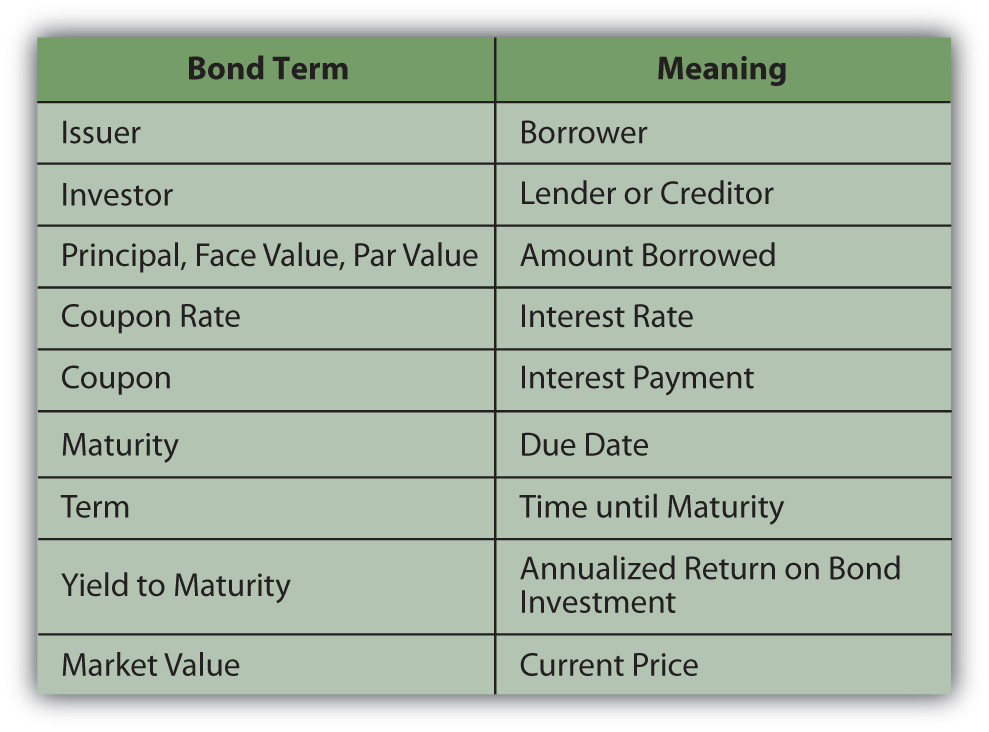

Personal Selling Ch. 1 Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Personal selling and sales promotion are both forms of marketing communication. (A) True (B) False, Sales does not meet the criterion of making a significant contribution to society. (A) True (B) False, In a fluctuating economy, salespeople make invaluable contributions by assisting in recovery cycles and by … Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 Seether co wants to issue new 20 year bonds for some - Course Hero Seether Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? → 8.75% Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

(Get Answer) - Chamberlain Co. wants to issue new 17-year bonds for ... Chamberlain Co. wants to issue new 17-year bonds for some much-needed expansion projects. The company currently has 10.6 percent coupon bonds on the market that sell for $954.83, make semiannual payments, and mature in 17 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of ... MSN MSN What are government bonds and how do you buy them in the UK? Coupon rate: the coupon rate of a bond is the value of the bond’s coupon payments expressed as a percentage of the bond’s principal amount. For example, if the principal (or face value) of a bond is £1000, and it pays an annual coupon of £50, its coupon rate is 5% per annum. Coupon rates are generally annualised, so two payments of £25 will also return a 5% coupon rate FIN401 Exam 2 (Chapter 7) Flashcards | Quizlet You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current market rate for this type and quality of bond is 7.5 percent, then you would expect: I, III, and IV only American Fortunes is preparing a bond offering with an 8 percent coupon rate.

for each of the following items before adjustment indicate the type of adjusting entry prepaid exp 5

When Interest Rates Rise, What Should You Do with Bonds? 08.08.2022 · There's the short-term rate set by the Fed, which is the base rate for the financial system. But after that there are different interest rates for different types of investments or loans. The interest rate, for example, on a 30-year mortgage is typically higher than on a 15-year mortgage, because the bank or whoever holds that loan is taking more risk that you won't pay …

News and Insights | Nasdaq Sep 29, 2010 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

Solved What coupon rate should the company set on its new | Chegg.com Transcribed image text: PQR Co. wants to issue new 10-year bonds for some much- needed expansion projects. The company currently has 5.8 percent coupon bonds on the market that sell for $1,125, make semiannual payments, and mature in 10 years.

(Solved) - What coupon rate should the company set on its new bonds if ... 1 Answer to Bond Yields BDJ ...

Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer At 8% Vo = 96/2× [1- (1.04)^-42/0.04] + 1000 (1.04)^-42 … View the full answer

Coupon Rate the Company Should Set on Its New Bonds - BrainMass 418233 Bond coupon rate and yield to maturity Not what you're looking for? Search our solutions OR ask your own Custom question. A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years.

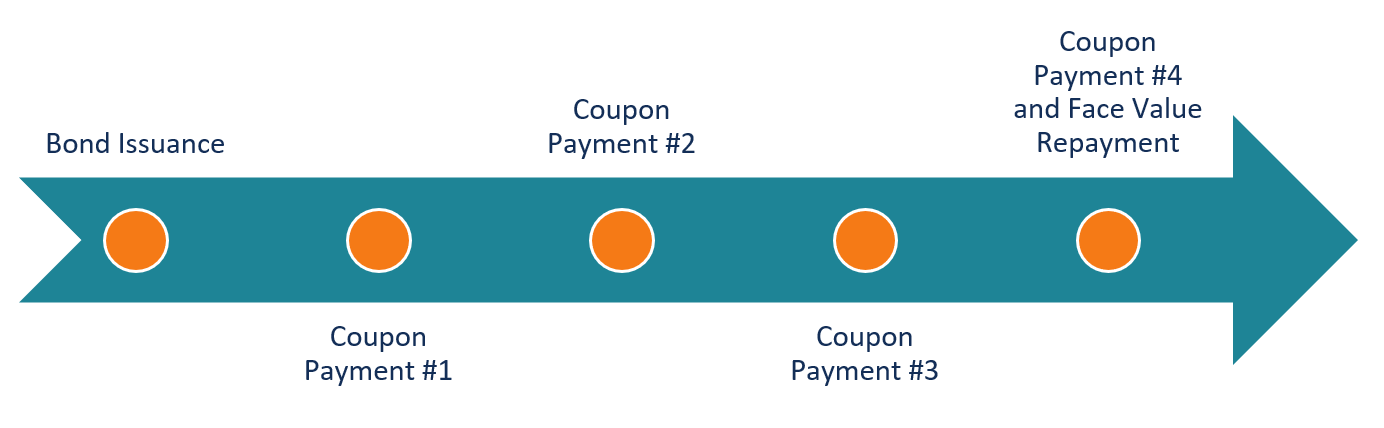

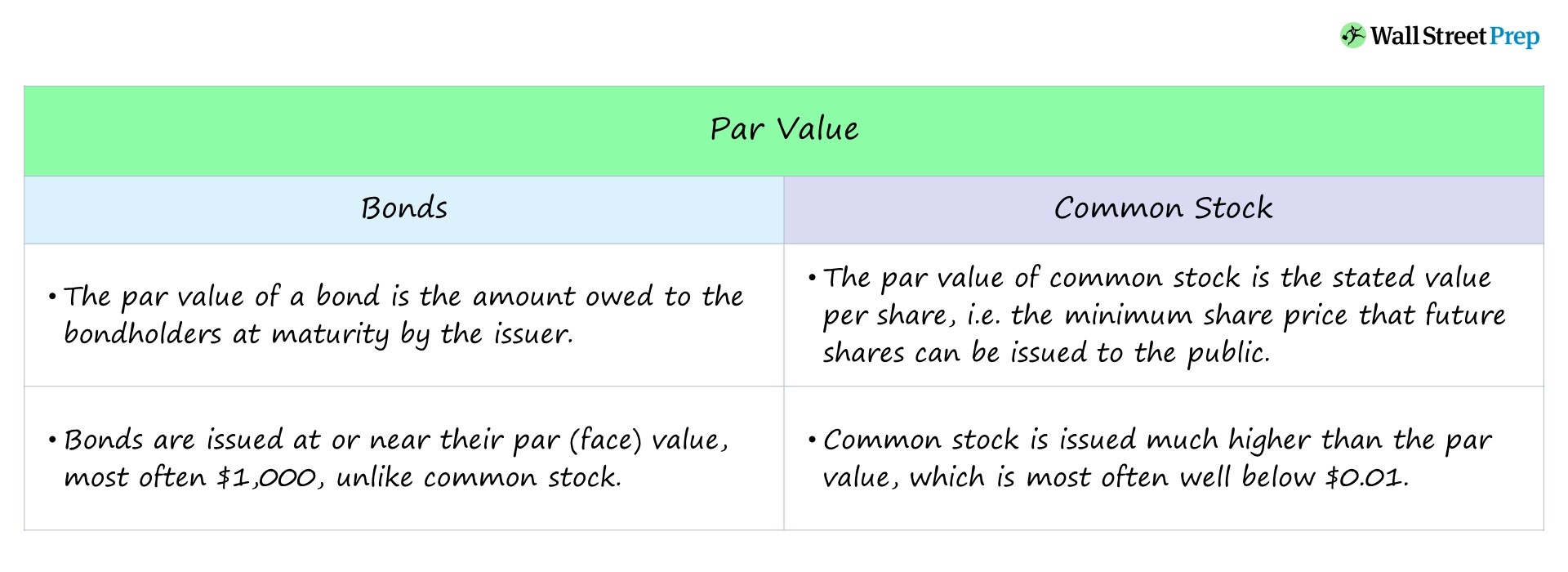

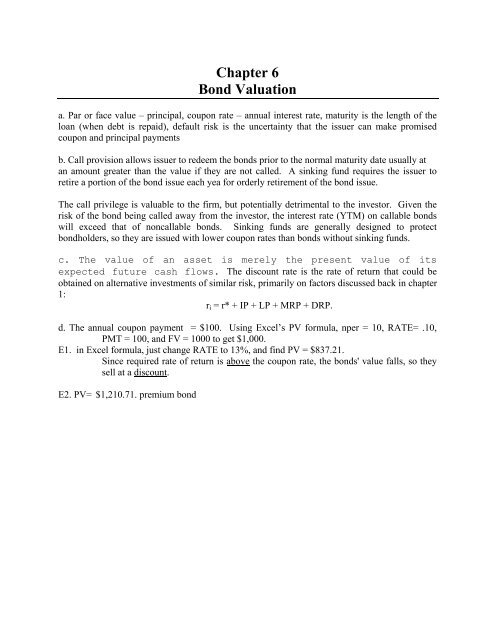

Bond Coupon Interest Rate: How It Affects Price - Investopedia Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's par value, also known as the "face value." A $1,000 bond has a face value of $1,000. If its coupon rate...

OneClass: Chamberlain Co. wants to issue new 20-year bonds for some mu Seether Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.8 percent coupon bonds on the market that sell for $868.69, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

Chamberlain co wants to issue new 16 year bonds for The company should set the coupon rate on its new bonds equal to the required return; the required return can be observed in the market by finding the YTM on outstanding bonds of the company. Enter 32 ±$1,035 $70 / 2 $1,000 N I/Y PV PMT FV Solve for 3.321% 3.321% ×2 = 6.64% Maturity of bond 8.10 years Maturity of bond 8.10 years

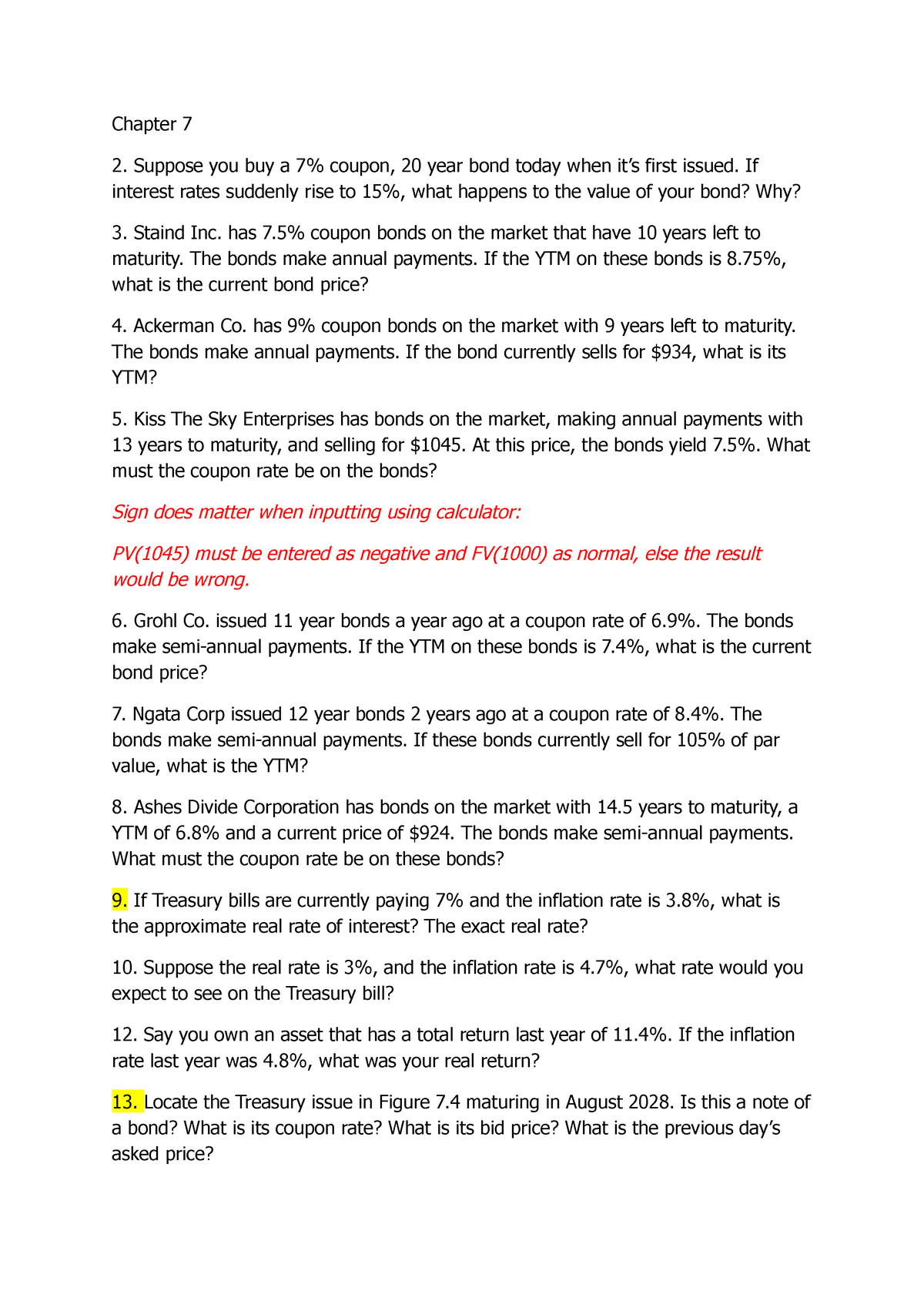

Finance 300 Exam 2 Flashcards | Quizlet Heginbotham Corp. issued 15-year bonds two years ago at a coupon rate of 7.9 percent. The bonds make semiannual payments. If these bonds currently sell for 109 percent of par value, what is the YTM? N = 26 I/Y = ? PV = 1090 PMT = 79/2 FV = 1000 I/Y = 3.422 You find a zero coupon bond with a par value of $10,000 and 19 years to maturity.

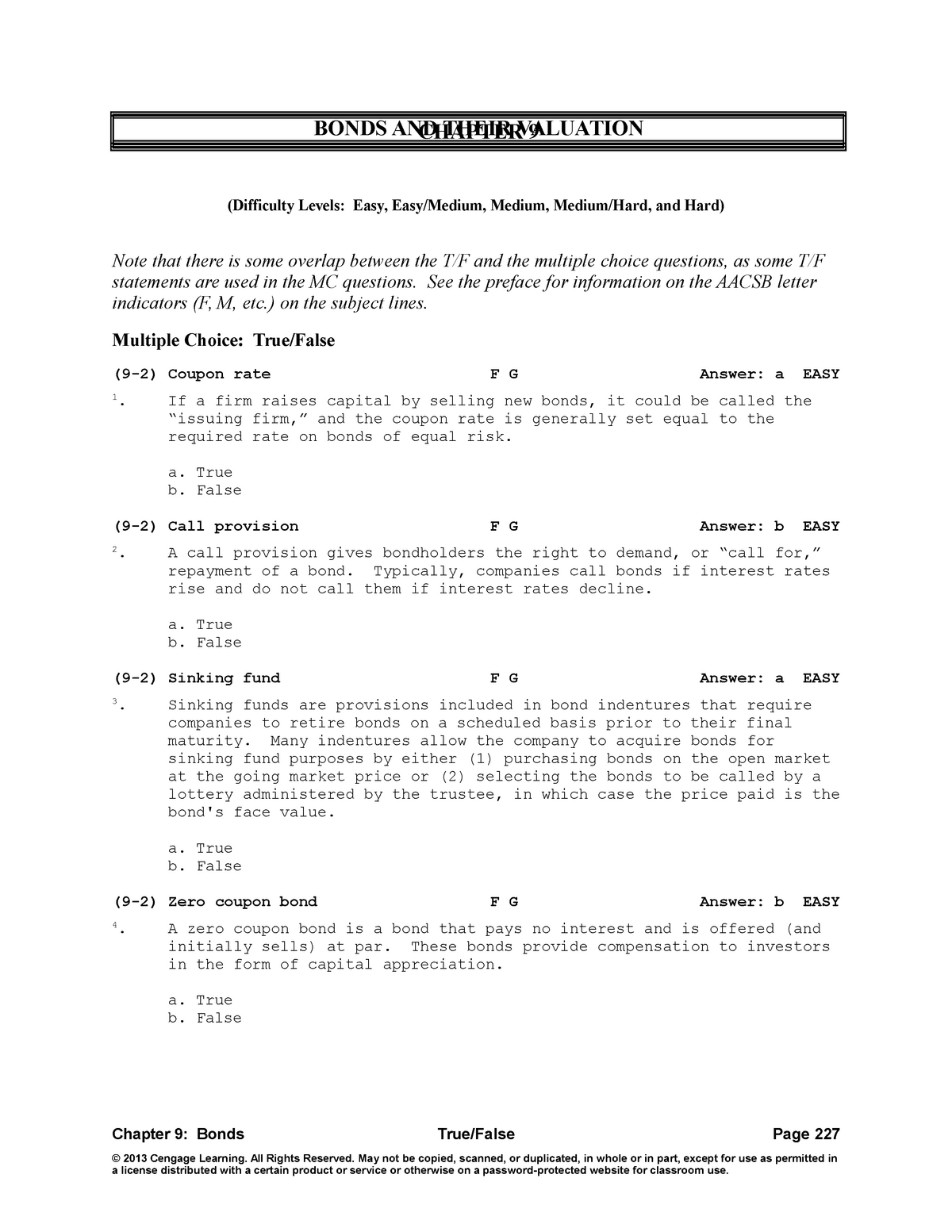

Finance Midterm 1 Flashcards | Quizlet If YTM = Coupon Rate... Price = Par Intrest Rate Risk increases when: -YTM increases -Price decreases -Coupon Rate decreases Premium Bond A bond that sells for more than the face value Zero Coupon Bond bond that makes no coupon payments, so its priced at a discount Discount Bond has a coupon rate that is less than the bond's YTM 1,333 solutions

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet the ease in which an asset can be converted to cash without significant loss of value RWB Inc., has 6% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 11%, what is the current bond price? A. $705.54 B. $1,000.00 C. $1,061.61 D. $1,134.11 E. $1,368.00 A. $705.54

eCFR :: 13 CFR Part 120 -- Business Loans This part regulates SBA's financial assistance to small businesses under its general business loan programs (“7(a) loans”) authorized by section 7(a) of the Small Business Act (“the Act”), 15 U.S.C. 636(a), its microloan demonstration loan program (“Microloans”) authorized by section 7(m) of the Act, 15 U.S.C. 636(m), and its development company program (“504 loans”) authorized ...

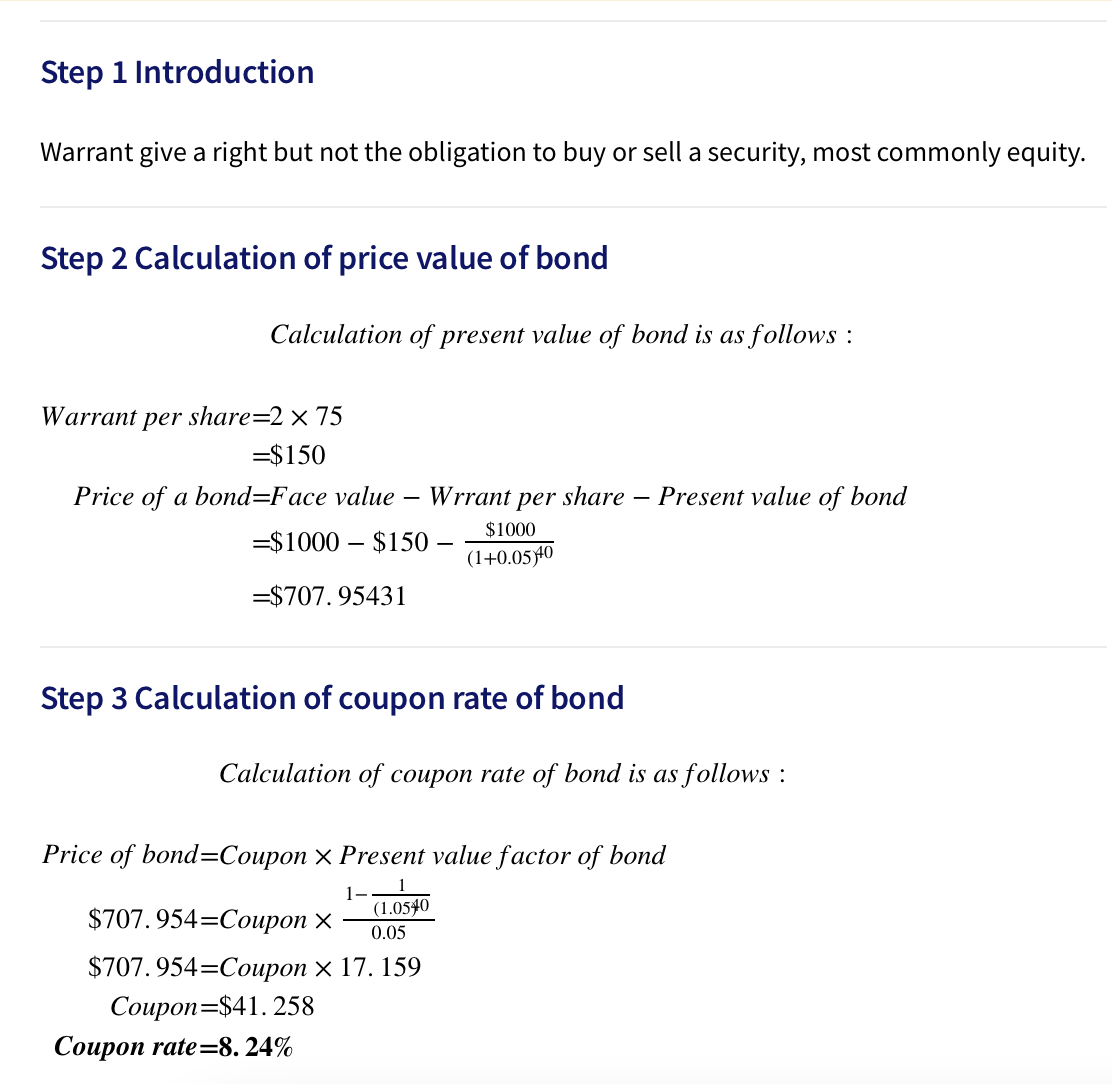

BDJ Co. wants to issue new 19-year bonds for some much-needed expansion ... Use financial calculator FV= $1000 PV= $1143 N= 19*2= 38 PMT = 0.103 * 1,000 * 0.5 == 51.5 Compute I= 4.37%*2= 8.74% If the company wants to sell the new bonds on par it should set the coupon rate as 8.74% because when ytm and coupon rate are the same the bond sells on par. Explanation: Advertisement

Inside.com: News and Community For Professionals Inside.com is an online community where professionals can dive into their interests. Get the latest in business, tech, and crypto on Inside.

Bond Yields RAK Co. wants to issue new 20-year bonds for...open 5 - Quesba Bond Yields RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5.7 percent coupon bonds on the market that sell for $1,048, have a par value of $1,000, make semiannual payments, and mature in 20 years.

Equity Valuation. Lecture Notes # 8. 3 Choice of the Appropriate ... 4 Investments: Notes 8, c by Yalçın 4 A growth stock is one whose expected rate of return is mainly due to the expected growth of cash flows Conversely a value stock is one whose expected rate of return is mainly due to the expected dividend yield In the case of ConEdison, 993 dividends amounted to $50, or, disregarding compounding issues, an annual dividend of D 0 = 2 Then, we can proxy the ...

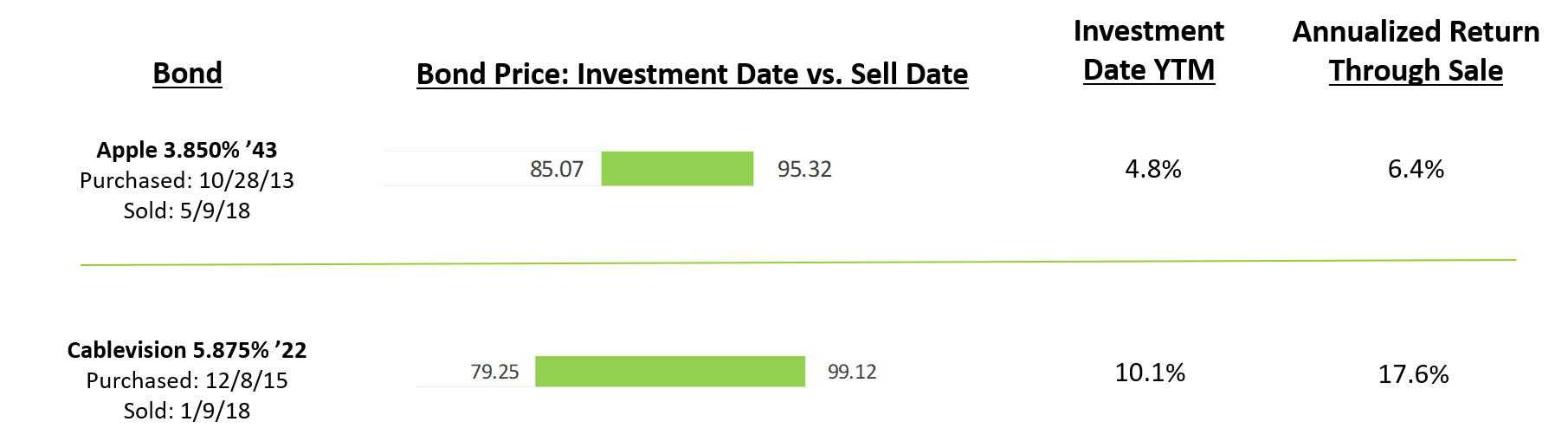

Relationship Between Interest Rates & Bond Prices - Investopedia May 16, 2022 · These examples also show how a bond's coupon rate and, consequently, its market price is directly affected by national interest rates. To have a shot at attracting investors, newly issued bonds ...

Prospect Capital Announces June 2022 Results: $0.21 per … 29.08.2022 · NEW YORK, Aug. 29, 2022 (GLOBE NEWSWIRE) -- Prospect Capital Corporation (NASDAQ: PSEC) (“Prospect”, “our”, or “we”) today announced financial results for our fiscal quarter and year ...

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145.

Pembroke co wants to issue new 20 year bonds for some - Course Hero See Page 1. Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? simranstory9180 is waiting for your help. Add your answer and earn points. Expert-verified answer jepessoa Answer: 5.36%

Press Releases | U.S. Department of the Treasury Statement by Secretary of the Treasury Janet L. Yellen on New Rule Under the Corporate Transparency Act September 28, 2022 Readouts READOUT: U.S. Department of the Treasury and the Office of the U.S. Special Presidential Envoy for Climate (SPEC) Host Discussion with Asset Managers and Insurers on the Opportunities and Challenges of Incorporating Climate …

Post a Comment for "45 what coupon rate should the company set on its new bonds if it wants them to sell at par"