43 how to calculate coupon rate from yield

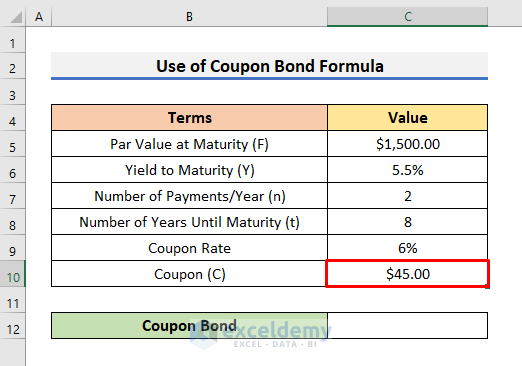

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

study.com › academy › lessonYield to Maturity Formula & Examples | How to Calculate YTM ... Dec 16, 2021 · The bond yield can also be matched to the current coupon rate when determining the bond yield itself. This is a table of corporate bond offerings from 1995-2019. The table also shows the different ...

How to calculate coupon rate from yield

› ask › answersHow Do I Calculate the Yield of an Inflation Adjusted Bond? Jul 18, 2022 · The real yield calculation would use the secondary market price (like any other bond) of $925, but use the inflation-adjusted coupon payment of $42. The real yield would thus be: 4.54% (42 ÷ 925). › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued. › Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value).

How to calculate coupon rate from yield. › coupon-rate-vs-interest-rateCoupon Rate vs Interest Rate | Top 8 Best Differences (with ... Particulars – Coupon Rate vs. Interest Rate Coupon Rate Interest Rate ; Meaning: The coupon rate can be considered as the yield on a fixed-income security. The interest rate is the rate charged by the lender to the borrower for the borrowed amount. Calculation : The coupon rate is calculated on the face value of the bond, which is being invested. › Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued. › ask › answersHow Do I Calculate the Yield of an Inflation Adjusted Bond? Jul 18, 2022 · The real yield calculation would use the secondary market price (like any other bond) of $925, but use the inflation-adjusted coupon payment of $42. The real yield would thus be: 4.54% (42 ÷ 925).

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 how to calculate coupon rate from yield"