38 us treasury coupon rate

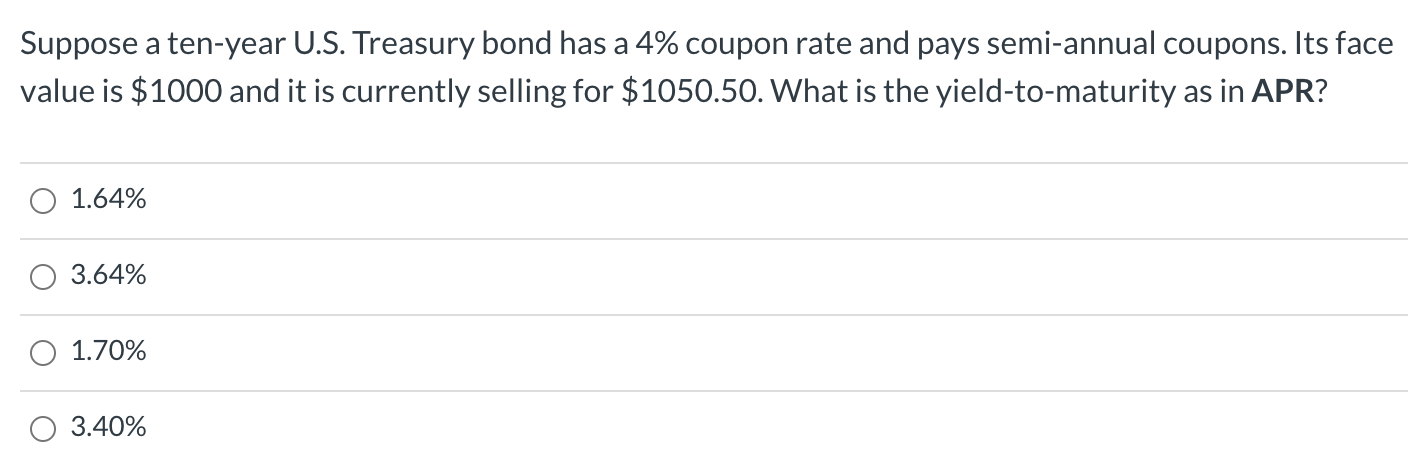

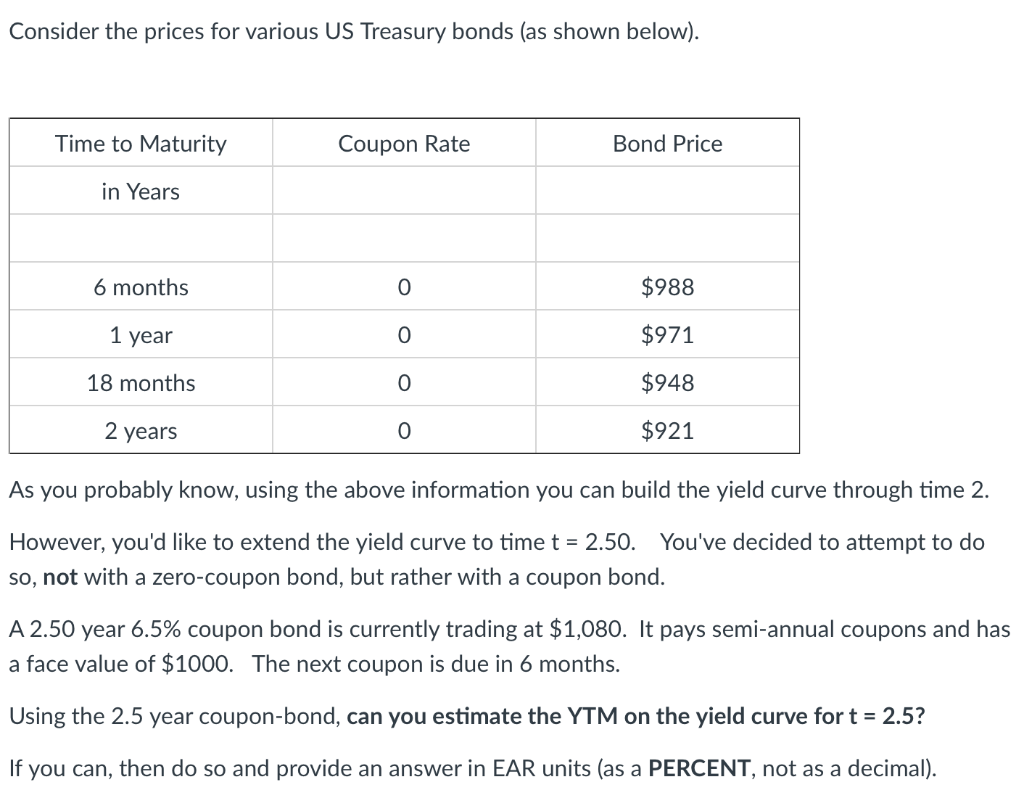

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Treasury Bill Rates - Nasdaq The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also...

Us treasury coupon rate

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

Us treasury coupon rate. Treasury Bills - Guide to Understanding How T-Bills Work Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills. ... They come in denominations of $1,000 and offer coupon payments every six months. The 10-year T-note is the most frequently quoted Treasury when assessing the performance of the bond market. It is also used to show the market's take on macroeconomic ... US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 10 Year Treasury (US10Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC. US3Y: U.S. 3 Year Treasury - Stock Price, Quote and News - CNBC Price 99.6797 Price Change -0.2266 Price Change % -0.2305% Price Prev Close 99.9062 Price Day High 100.0469 Price Day Low 99.5703 Coupon 4.25% Maturity 2025-10-15 Latest On U.S. 3 Year Treasury... Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

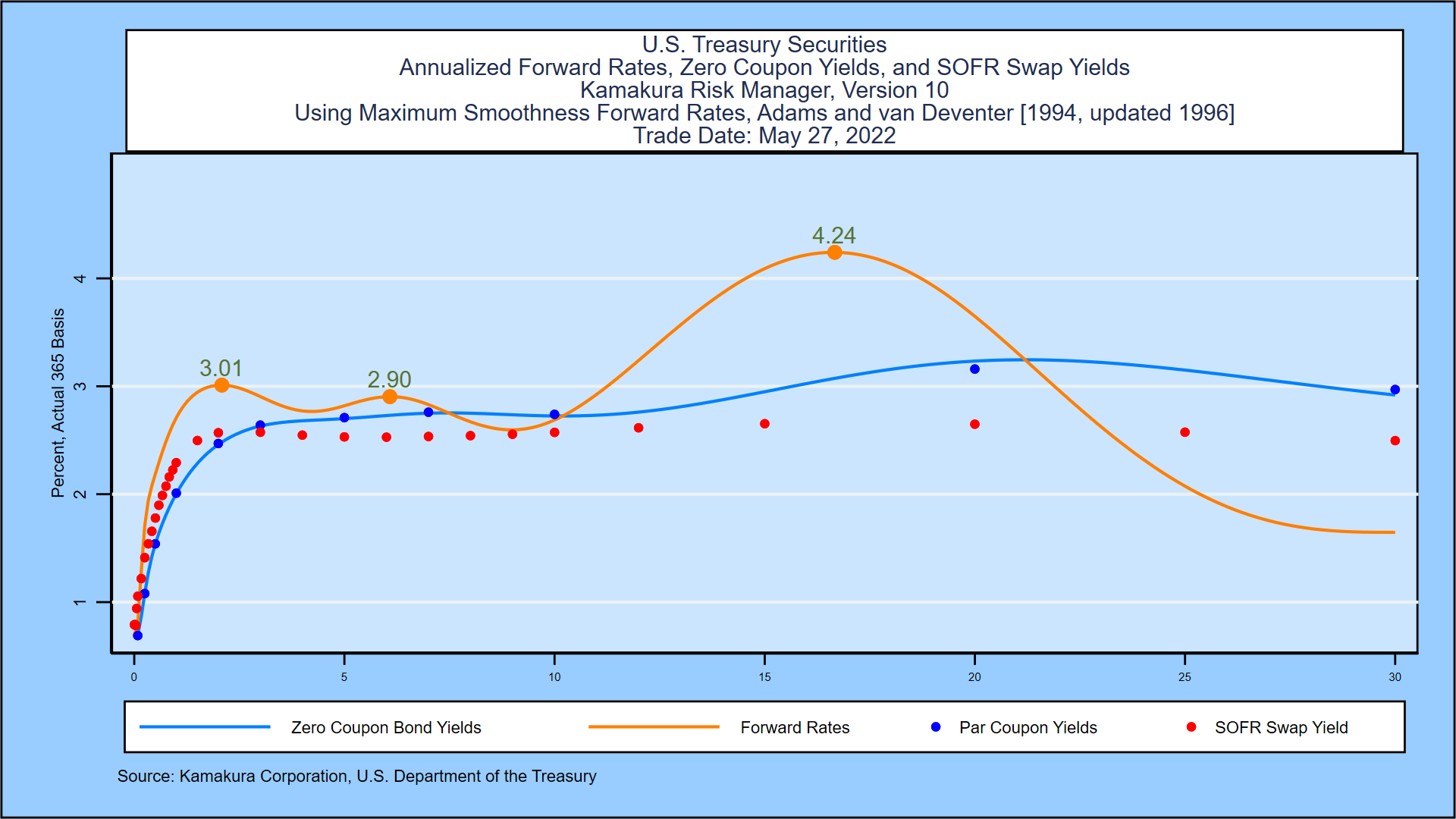

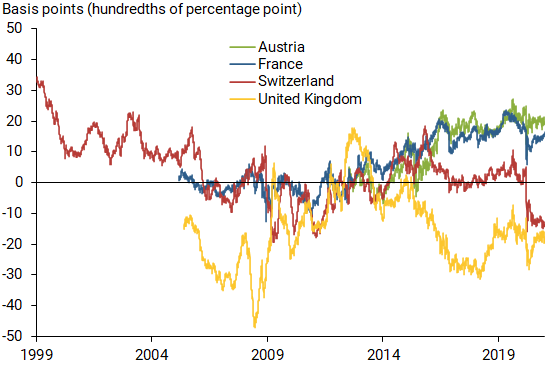

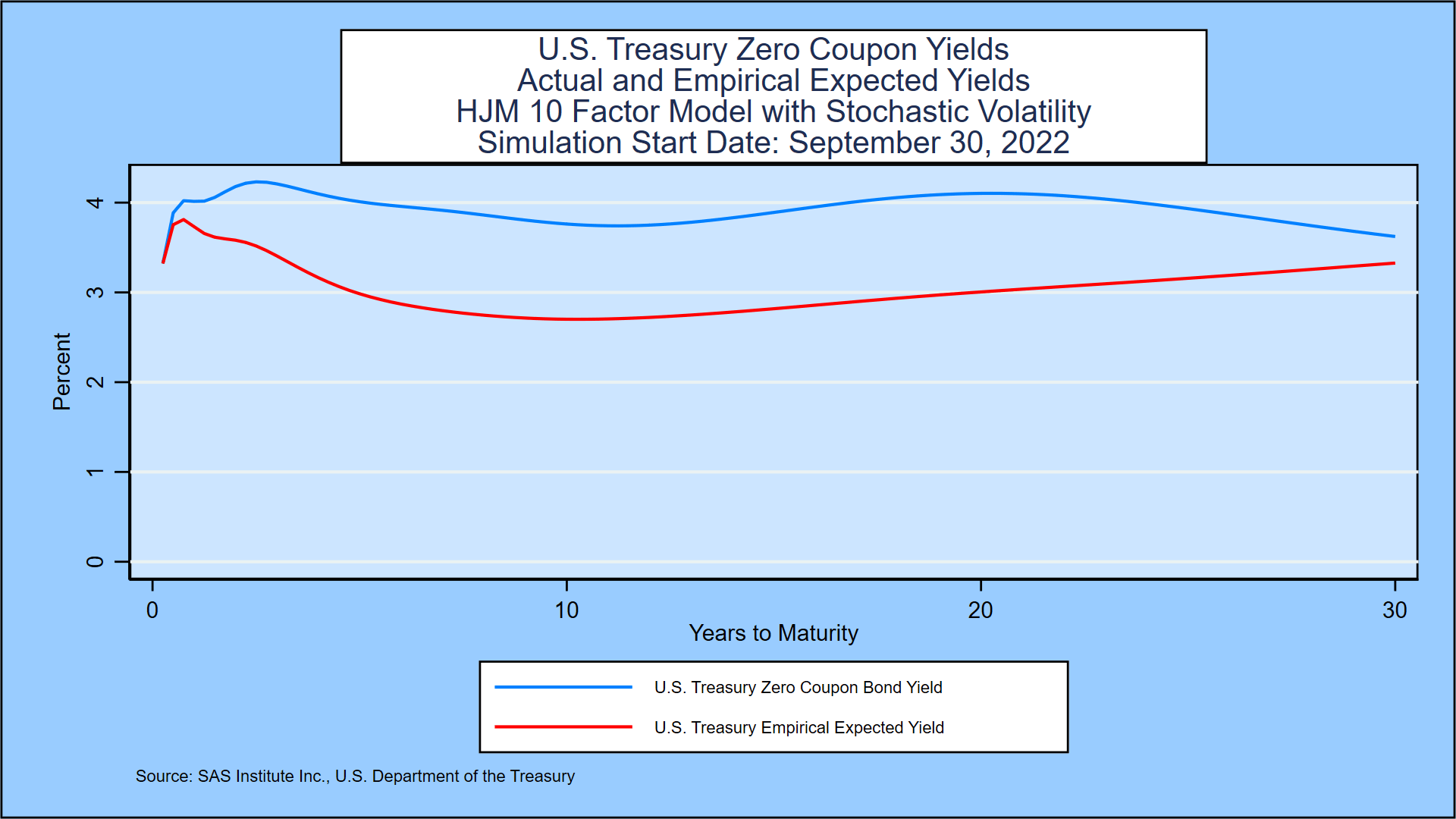

US Treasury Zero-Coupon Yield Curve - Nasdaq US Treasury Zero-Coupon Yield Curve. From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 16 hours ago, on 28 Oct 2022 Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... How does the U.S. Treasury decide what coupon rate to offer on Treasury ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market. For example, it is used as a benchmark for other interest ... 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 4.32%, compared to 4.38% the previous market day and 1.93% last year. This is lower than the long term average of 4.36%. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the...

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch One-year Treasury yield jumps 30 basis points to 4.53%, leading rates higher across the curve. Oct. 14, 2022 at 1:30 p.m. ET by MarketWatch.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury Reporting Rates of Exchange This report provides exchange rate information under Section 613 of Public Law 87-195 dated September 4, 1961 (22 USC 2363 (b)) which gives the Secretary of the Treasury sole authority to establish the exchange rates for all foreign currencies or credits reported by all agencies of the government. The primary purpose is to ensure that foreign ...

TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview | MarketWatch Coupon Rate 4.250% Maturity Oct 15, 2025 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Aggressive Treasury selloff pushes 2- and 3-year yields above 4.3% in...

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

What Is a Treasury Note? How Treasury Notes Work for Beginners What Do Treasury Notes Pay? Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ...

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 4.04%, compared to 4.10% the previous market day and 1.63% last year. This is lower than the long term average of 4.26%. Stats Related Indicators Treasury Yield Curve

Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 us treasury coupon rate"