45 government zero coupon bonds

Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) Graph and download economic data for Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) from 1990-01-02 to 2022-06-24 about bonds, 5-year, yield, interest rate, interest, rate, and USA. Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Yield from Government 10 bonds UK 2022 | Statista Published by Statista Research Department , May 2, 2022 The monthly average yield on 10 year nominal zero coupon British Government Securities in the United Kingdom (UK) has seen a continued...

Government zero coupon bonds

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity. Calling Bitcoin a Ponzi Scheme is Lazy Thinking - Medium Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond. ... government-issued zero-coupon perpetual bonds cannot end in a run either, because the central bank can always create more currency needed to keep buying them ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

Government zero coupon bonds. SGS Bonds: Information for Individuals Tradable government debt securities that pay a fixed coupon every 6 months. Maturity: 2 to 30 years. A Singapore Government Agency Website. Show menu . ... Singapore Government Securities (SGS) bonds pay a fixed rate of interest and have maturities ranging from 2 to 30 years. There are three categories of SGS bonds - SGS (Market Development ... Zero Coupon 2025 Fund | American Century Investments Invests in zero-coupon bonds, providing a dependable rate of return if held to maturity. ... For example, the percentage of foreign or domestic stocks held by an equity fund or the percentage of corporate and government securities owned by a bond fund. The U.S./Foreign Convertibles grouping includes Convertible Bonds, Equity Linked Securities ... Government, Zero-Coupon & Floating-Rate Bonds - Study.com Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face... Russian Government Bond Zero Coupon Yield Curve, Values (% per annum ... Russian Government Bond Zero Coupon Yield Curve, Values (% per annum)

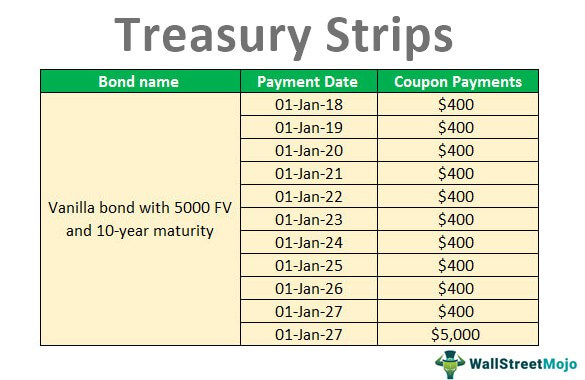

25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund - PIMCO The ICE BofAML Long U.S. Treasury Principal STRIPS Index. The ICE BofAML Long US Treasury Principal STRIPS Index is an unmanaged index comprised of long maturity Separate Trading of Registered Interest and Principal of Securities (STRIPS) representing the final principal payment of U.S. Treasury bonds. It is not possible to invest directly in ... PIMCO 25+ Year Zero Coupon US Treasury Index ETF ZROZPIMCO 25+ Year Zero Coupon US Treasury Index ETF. PIMCO 25+ Year Zero Coupon US Treasury Index ETF. Price: undefined undefined. Change: Category: Government Bonds. Last Updated: Jun 23, 2022. ZROZ Stock Profile & Price Holdings Holdings Analysis Charts Price and Volume Charts Fund Flows Charts Performance Technicals Realtime Rating NEW! United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.190% yield. 10 Years vs 2 Years bond spread is 41 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value.

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value Chapter 7, interest rates and bonds - StuDocu You are comparing a 10-year, 3% U. government zero coupon bond (which is priced to yield 4%) to a 10-year, 3% coupon bond issued by the Aerocar Motor Co. (which is priced to yield 5%). The difference between the two yields is due to: I. maturity premium II. default premium III. liquidity premium. a. III only b. II and III c. II only d. I only Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

FGN Bonds - Debt Management Office Nigeria There are also zero-coupon bonds(not yet in issue in Nigeria) whereby both interest and principal are repaid at the final maturity date of the bond. Tenor: Minimum of two (2) years. There are bonds with maturities of 3. 5, 7 and 10 years, in issue and for the future we may have bonds with maturities of 15, 20,30 years or more ...

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing ... - Insider With a zero-coupon bond , you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures. For...

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,654 datasets) Refreshed 10 hours ago, on 7 Jul 2022 Frequency daily Description These yield curves...

United States Government Bonds - Yields Curve The United States 10Y Government Bondhas a 3.084%yield. 10 Years vs 2 Years bond spreadis -2.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rateis 1.75%(last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

Post a Comment for "45 government zero coupon bonds"