39 pricing zero coupon bonds

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... Zero Coupon Bond Definition and Example | Investing Answers How Interest Rate Fluctuations Affect the Price of Zero Coupon Bonds. Zero coupon bonds are sensitive to interest rate fluctuations. The price you can get on the open market will be determined by current interest rates. If you purchased a zero coupon bond at 5% and interest rates rose and offered a 10% yield, your zero coupon bond won't look as ...

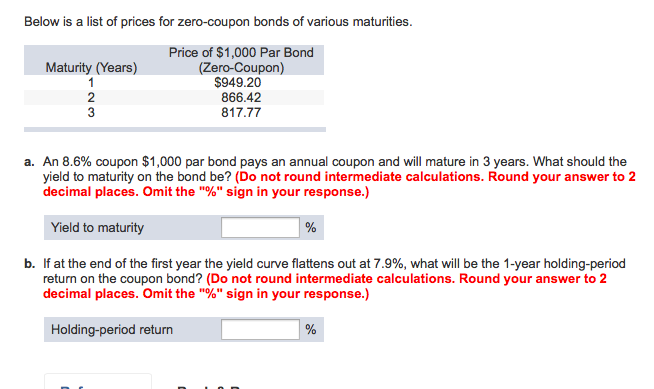

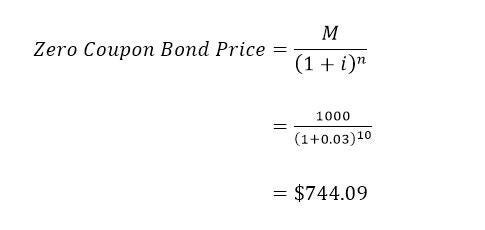

Zero Coupon Bonds - Financial Edge Training Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity. Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value.

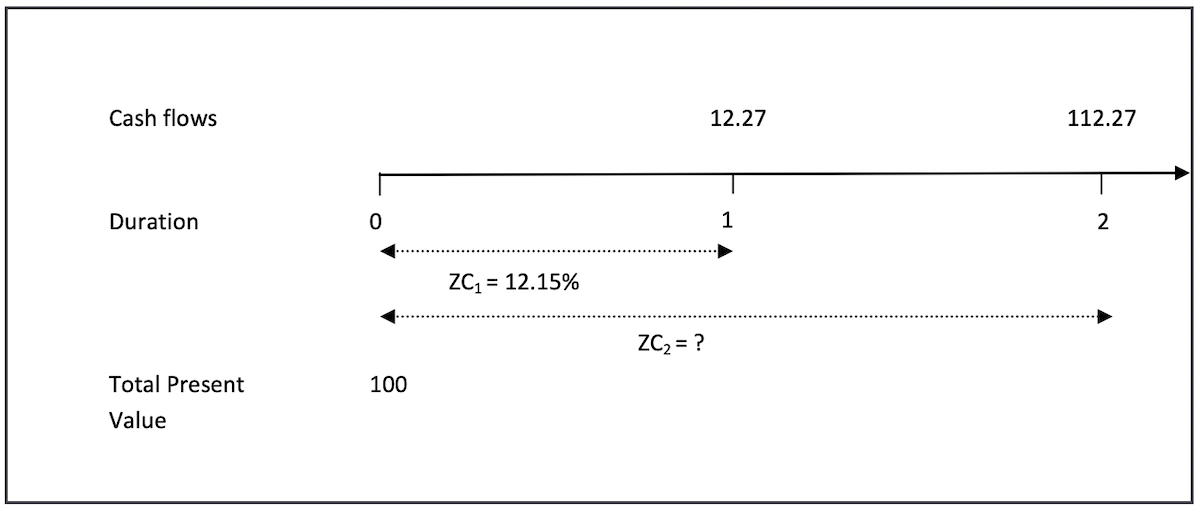

Pricing zero coupon bonds

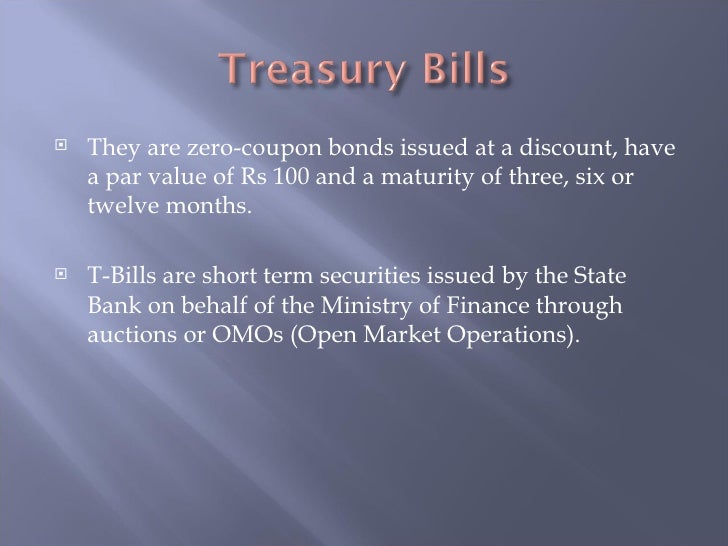

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... The price of zero-coupon bonds is calculated using the formula given below: See also What Is a Treasury Bond and How Does It Work? Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

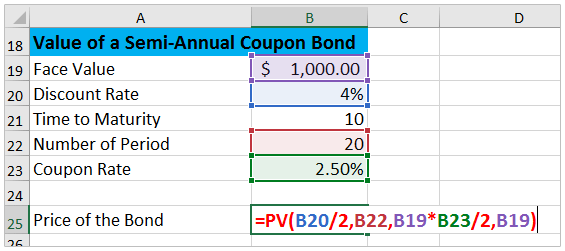

Pricing zero coupon bonds. How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero-Coupon Bond: Formula and Excel Calculator To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

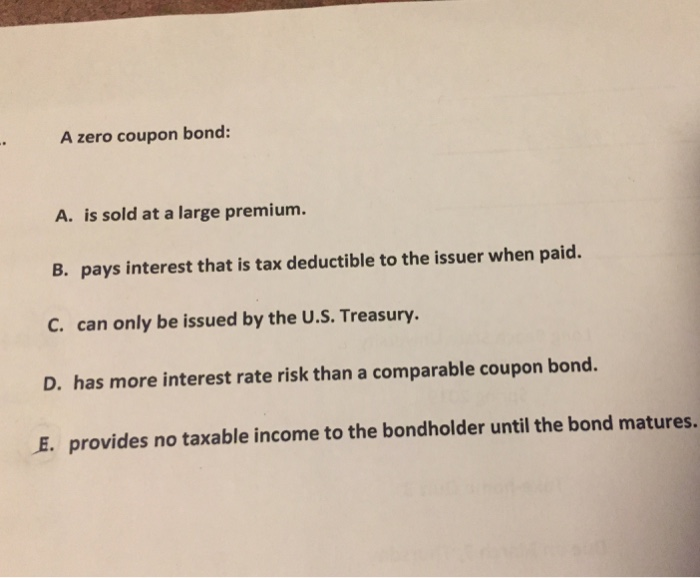

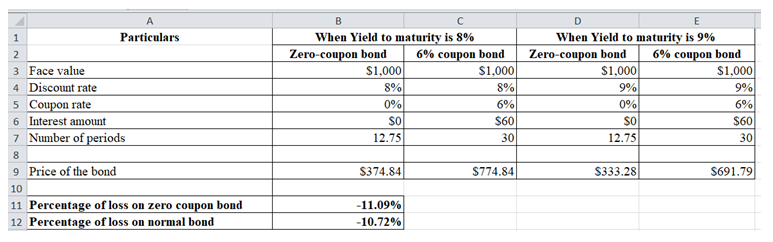

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. open.lib.umn.edu › financialaccounting › chapter14.3 Accounting for Zero-Coupon Bonds – Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ...

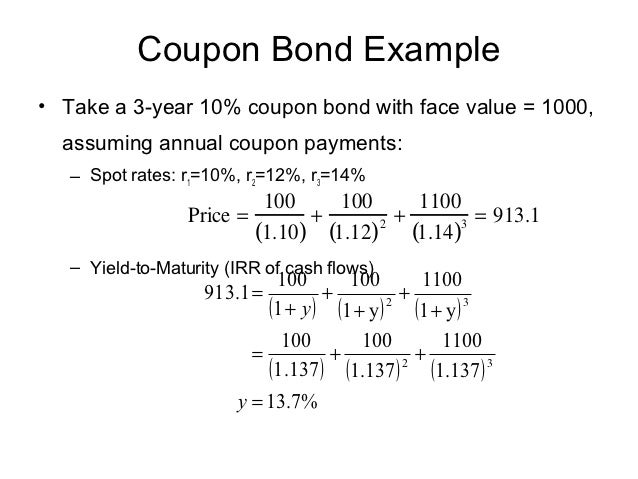

› articles › bondsHow Bond Market Pricing Works - Investopedia Aug 31, 2020 · The spread is used both as a pricing mechanism and as a relative value comparison between bonds. For example, a trader might say that a certain corporate bond is trading at a spread of 75 basis ... › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Pricing of zero-coupon bond options - Big Chemical Encyclopedia Pricing of zero-coupon bond options. Starting from the risk-neutral bond price dynamics (5.4), we derive the well known closed-form solution for the price of a zero-coupon bond option. Thus, as shown in section (2.1) the price of a call option on a discount bond is given by [Pg.44] the abiUty to derive a closed-form of t z) crucially depends on ... › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

How Premium Bonds are Priced | Zero Coupon Bond | Savings Let's consider a zero coupon bond with a par value of $5,000 and a maturity period of 5 years. Let's assume that the required rate of return is 10%. Plugging these values in the bond pricing formula: Price = [$5,000 / (1+.05)^10] = $3069.5 Compare this price with the price of the plain vanilla bond that we calculated in the last example.

corporatefinanceinstitute.com › bond-pricingBond Pricing - Formula, How to Calculate a Bond's Price A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Advantages and Risks of Zero Coupon Treasury Bonds Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

Zero Coupon Bond | Definition, Formula & Examples - Study.com Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5 years. According to the latest quote, the $10,000 Zero Coupon Bond of Company X is trading at $9,110. You thus have a decision...

Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ...

Investor's Guide to Zero-Coupon Municipal Bonds - Project Invested An estimated $11.1 billion in municipal bonds are traded daily in the secondary market. Yield (or Current yield). The annual percentage rate of return earned on a bond calculated by dividing the coupon interest rate by its purchase (market) price. Zero-coupon bond. A bond for which no periodic interest payments are made.

Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond zero-coupon risk-neutral. Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. 158 4 4 ...

Price of a zero coupon bond - Finance pointers Therefore the price of the zero coupon bond is = $ 5,000 / ( 1 + 0.06 ) 10 = $ 5,000 / ( 1.06 ) 10 = $ 5,000 / 1.790848 = $ 2,791.973885 = $ 2,791.97 ( when rounded off to two decimal places ) The price of the zero coupon bond = $ 2,791.97 Note : ( 1.06 ) 10 = 1.790848 is calculated using the excel function =POWER (Number,Power)

What is a Zero Coupon Bond? Who Should Invest? | Scripbox The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = (Face value / (1+YTM)^n) - 1

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... The price of zero-coupon bonds is calculated using the formula given below: See also What Is a Treasury Bond and How Does It Work? Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "39 pricing zero coupon bonds"