45 present value of zero coupon bond calculator

› terms › pPresent Value (PV) Definition - investopedia.com Feb 01, 2022 · Learning how to use a financial calculator to make present value calculations can help you decide whether you should accept such offers as a cash rebate, 0% financing on the purchase of a car, or ... Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

What Is Bond Valuation? - The Balance - Present value of payment two years out = $16.20/ (1.0097) 2 = $15.89 - Present value of payment three years out = $16.20/ (1.0097) 3 = $15.74 - Present value of the final payment = $1,016.20/ (1.0097) 4 = $977.71

Present value of zero coupon bond calculator

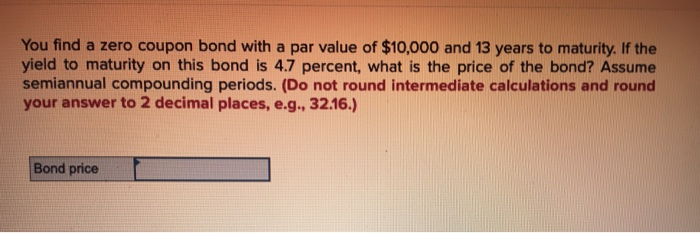

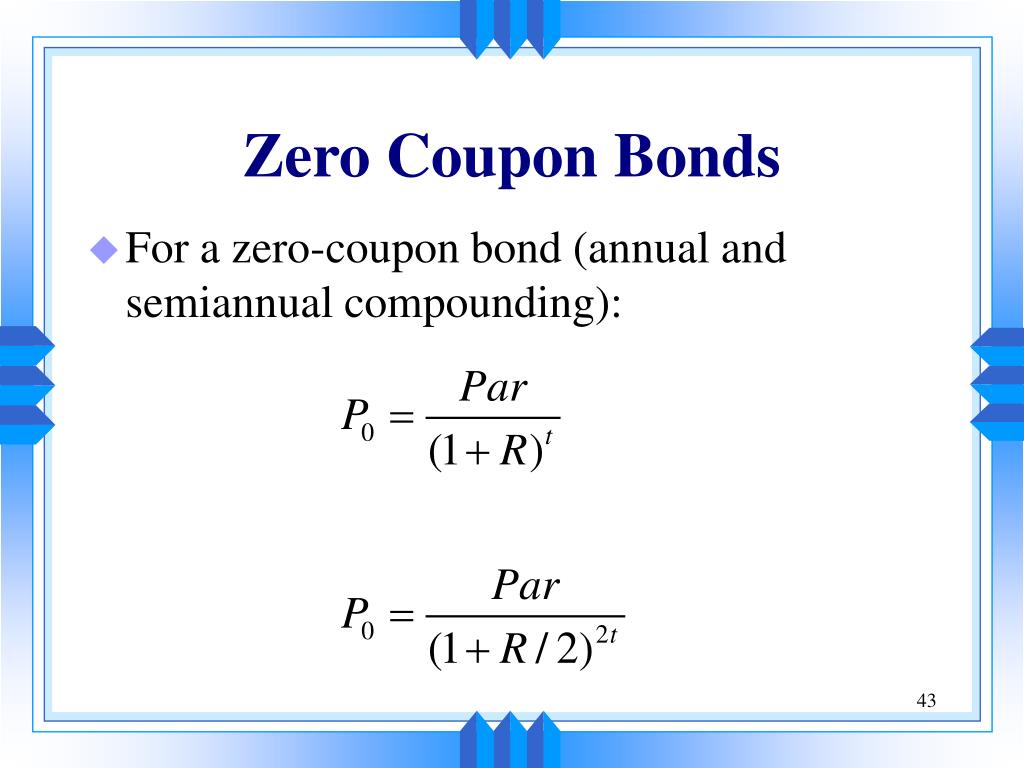

What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is ... dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Yield to Maturity - What it is, Use, & Formula - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a ...

Present value of zero coupon bond calculator. Learn to Calculate Yield to Maturity in MS Excel - Investopedia where: PV = present value of the bond P = payment, or coupon rate × par value÷ number of payments per year r = required rate of return ÷number of payments per year Principal = par (face) value of... How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =... How To Check or Calculate the Value of a Savings Bond Online Denomination. Serial number. Issue date. Once you have this information, you can use a savings bond calculator to find out how much your bond is worth right now. The primary site to do this is TreasuryDirect.gov, which is run by the U.S. government. Along with the calculator, you can find detailed instructions on determining your bond's future ... › Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =... How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

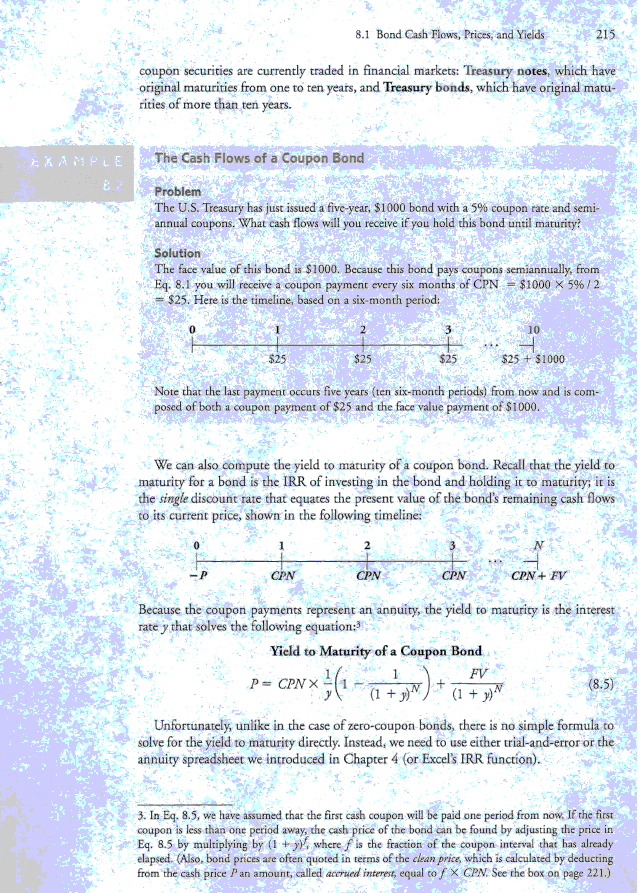

Accounting for a non interest bearing note — AccountingTools Calculate the present value of the note, discounted based on the market rate of interest. Multiply the market rate of interest by the present value of the note to arrive at the amount of interest income. Record the interest income as a credit to interest income and a debit to an asset account for the investment in the note. Yield to Maturity Calculator | Calculate YTM Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Determine the bond price; The bond price is the money an investor has to pay to acquire the bond. It can be found on most financial data websites. The bond price of Bond A is $980. Determine the face value; The face value is equivalent to the ... Bond Valuation Overview (With Formulas and Examples) Present value of the face value = $888.49. To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value. Value of bond = $92.93 + $888.49. Value of bond = $981.42. How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The price of a bond at the time we purchase it is the present value of all the future streams of payments. For example, there is a bond with a $2000 face value which will pay a coupon rate of 8% once per year. If the bond will be matured in 5 years and the annual compound interest rate is 6% for all loan terms, what is the price of the bond?

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

[Solved] The prices of zero-coupon bonds with par value of $1000 and various maturities are: 1 ...

How to Price Bonds: Formula & Calculation - Study.com Credit quality or the bond issuer's reputation. To find the price of a bond, add up all the present values of the bond's future payments using the present value formula: PV = FV / ( (1+ r )^ n) A ...

Zero Coupon Bonds: Calculating Price, Interest, and Value The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. The bond's duration is 3.6481 years. You expect that interest rates will fall by .3% later today. * Use the modified duration to find the approximate percentage change in the bond's price.

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Post a Comment for "45 present value of zero coupon bond calculator"