38 formula for coupon rate

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! Bond Coupon Rate Calculator

Difference Between Coupon Rate and Discount Rate (With ... Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

Formula for coupon rate

Cost of Debt (kd): Pre-Tax and After-Tax Formula with ... Annual Coupon Rate (%): 6.0%; Term (# of Years): 8 Years; Cost of Debt Calculation [Example 1] Provided with these figures, we can calculate the interest expense by dividing the annual coupon rate by two (to convert to a semi-annual rate) and then multiplying by the face value of the bond. › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) Thus Cube Bank will pay $463.19 and will receive $1000 at the end of 10 years, i.e., on the maturity of the Zero Coupon Bond, thereby earning an effective yield Effective Yield Effective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Formula for coupon rate. Coupon Rate Formula & Calculation | Coupon Rate vs ... Coupon Rate Formula. To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Coupon Rate Calculator. This calculator calculates the coupon rate using face value, coupon payment values.

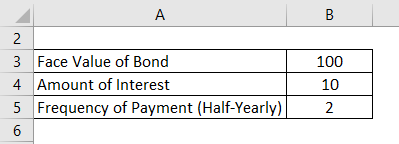

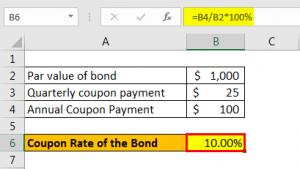

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% Bond Yield Formula | Step by Step Calculation & Examples The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond's face value with the coupon rate. › discounting-formulaDiscounting Formula | Steps to Calculate Discounted Value ... Coupon frequency= semi-annually; 1 st Settlement date=1 st Jan 2019; Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of ... What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

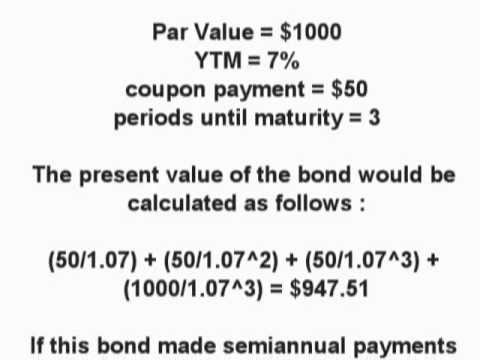

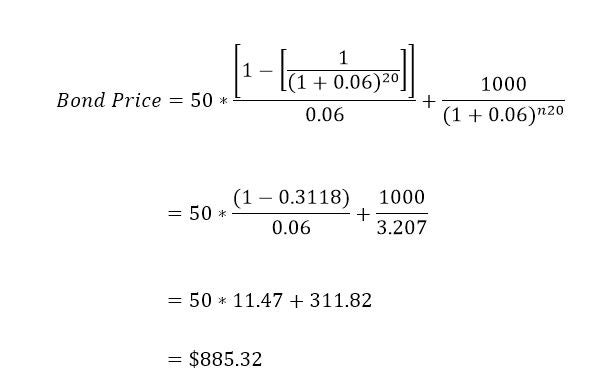

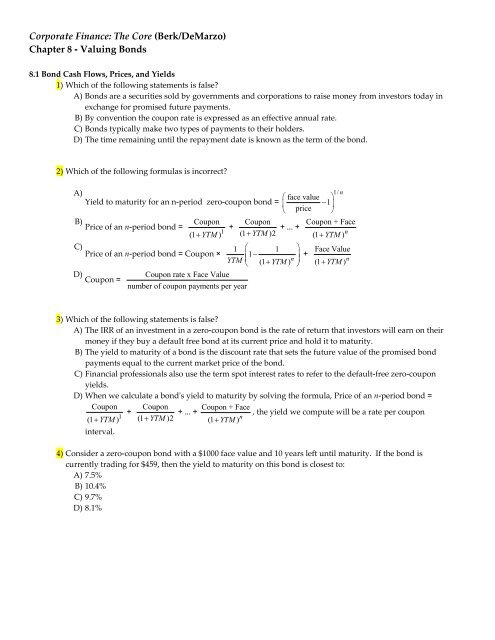

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example Georgia has a 10-year bond of company XYZ with a nominal value of $1,000 and a 20-year maturity. The rate pays 8% annually. Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Coupon Rate (C) - This is the periodic payment, usually half-yearly or yearly, given to the purchaser of the bonds as interest payments for purchasing the bonds from the issuer. The bond prices are then calculated using the concept of Time Value of Money wherein each coupon payment and subsequently, the principal payment is discounted to ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Bond Formula | How to Calculate the Price of Coupon ... The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Coupon Equivalent Rate (CER) Definition - Investopedia The coupon equivalent rate (CER) is calculated as: Find the discount the bond is trading at, which is face value less market value. Then divide the discount by the market price. Divide 360 by the...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. 3 Calculate the payment by frequency.

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a ...

Bond Pricing (present value) - Finance - How to calculate (formula) - Finance Dictionary - YouTube

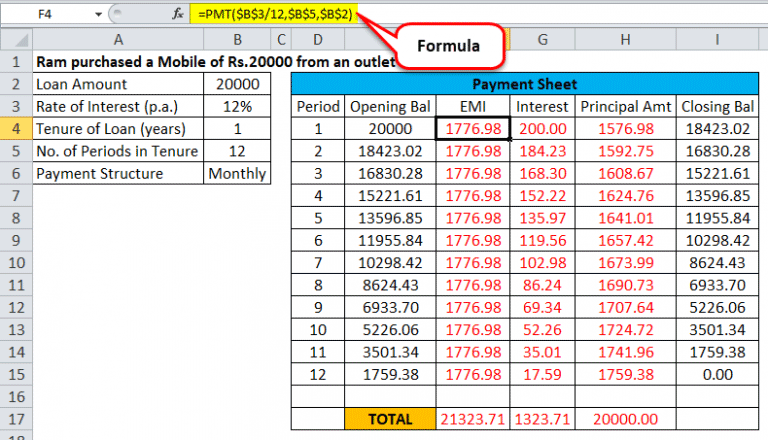

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

Coupon Rate Definition A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Rate - Meaning, Calculation and Importance Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds. Bonds pay interest to their holders. The coupon rate is the amount of interest the bondholder receives.

Difference Between Coupon Rate and Required Return (With ... Main Differences Between Coupon Rate and Required Return. Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) Thus Cube Bank will pay $463.19 and will receive $1000 at the end of 10 years, i.e., on the maturity of the Zero Coupon Bond, thereby earning an effective yield Effective Yield Effective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes ...

Cost of Debt (kd): Pre-Tax and After-Tax Formula with ... Annual Coupon Rate (%): 6.0%; Term (# of Years): 8 Years; Cost of Debt Calculation [Example 1] Provided with these figures, we can calculate the interest expense by dividing the annual coupon rate by two (to convert to a semi-annual rate) and then multiplying by the face value of the bond.

Post a Comment for "38 formula for coupon rate"